All it takes is a few clicks.

200+

Years Proudly Serving Our Customers

1MM+

Small Business Customers

5★

Professional Liability Insurance Provider 2023 by NerdWallet**

What Is Professional Liability Insurance Coverage?

Professional liability insurance protects businesses when employees make mistakes in the professional services they’ve provided to customers or clients. This coverage is also known as errors and omissions insurance (E&O). Even if you’re an expert in your business, mistakes happen. And if your client or customer thinks a mistake in your professional services caused a financial loss, they can sue you.

Why Is Professional Liability Insurance Important?

If your business offers professional services and you don't have professional liability coverage, you can be held liable if a customer believes you made a mistake. Even if it didn’t cause them financial loss, you can still get sued. Small business owners should consider having professional liability coverage because it protects businesses when they need it most. You should especially consider having this coverage if you:

- Provide professional services

- Offer advice to clients

- Are required to have complete coverage

What Does Professional Liability Insurance Cover?

Professional liability insurance for small businesses can help protect against claims of:

Negligence

If the professional services that you or your company provided result in damage or injury to a client. For example, your accounting firm makes a clerical error that costs your client thousands of dollars.

Misrepresentation

If a client claims that false or misleading information convinced them into a contract agreement with you or your company, which lead to damages to the client. For example, your real estate firm recently sold a townhouse to a couple that was planning on starting a daycare. However, when the couple moved in, the townhouse association informed them they couldn’t use the property for a business. The new owners decide to sue you for negligence.

Inaccurate Advice

If a customer claims that you provided advice that caused them damage. For example, a client sues your florist shop for errors in the services you provided after you failed to deliver flowers on time for their wedding.

Personal Injury

If someone accuses you or your business of libel or slander, whether it’s true or not. For example, a competitor claims that your new advertisements are slandering their business and sue you for damages.

Copyright Infringement

If someone claims you or your business used their copyrighted work without their permission and they sue you for copyright infringement. For example, a sound engineer sues your company for using one of their sounds without their permission in one of your new advertisements.

Defense Costs

Professional liability insurance can help cover your defense costs if a client sues you for mistakes in the professional services you provided them. Defense costs include attorney fees and other court-related expenses.

Even if you didn’t do anything wrong and believe you’ve made no mistakes, your client can still sue your business. Without coverage, you’ll have to pay expensive legal defense costs out of pocket.

Who Needs Professional Liability Insurance Coverage?

Professional liability insurance is an important coverage that business owners who provide a service to a client or customer should have. You’ll want to get professional liability insurance coverage if you:

- Have to sign a contract that requires you to carry coverage

- Offer professional services directly to customers

- Regularly give advice to clients

Be aware that some states require this type of business insurance. Learn more about who needs professional liability insurance today.

We offer professional liability insurance for a number of different industries, including the following:

How Much Does Professional Liability Insurance Cost?

Your cost is unique to your business. What you pay for professional liability insurance will vary by product, limits chosen and risk class or hazard group of your business.

| Product | Avg. Minimum Monthly Premium***1 |

|---|---|

| Misc. Professional Liability Standalone Coverage | $76 |

| Misc. Professional Liability Endorsements | $32 |

| Architects and Engineers Professional Liability | $257 |

| Healthcare Professionals Professional Liability | $98 |

| Errors & Omissions Insurance for Technology Companies | $86 |

*** Quotes will vary by business depending on the size of your business, the state your business is located in, coverage limits chosen, and the risk class your business is associated with.

Factors that can impact your professional liability insurance cost include:

- Policy details, like coverage limits

- Type of business

- Location

- Business size, number of employees and clients

- Years in business

- Claims history

You can work with our specialists to get the right amount of errors and omissions (E&O) insurance coverage for your business. Backed by more than 200 years of experience, we can help protect you with professional liability insurance for small business.

Looking for Professional Liability Coverage?

The Hartford makes it easy to get a professional liability insurance quote online.

How Does Professional Liability Insurance Work?

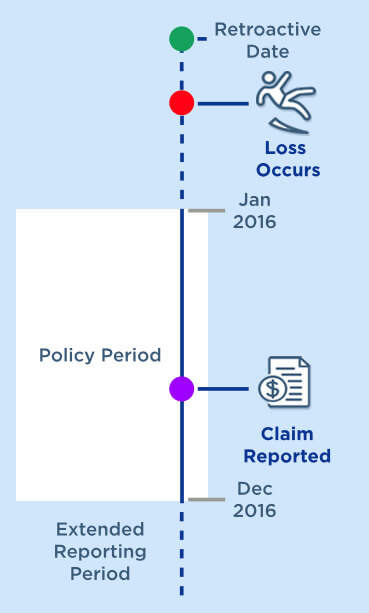

Many insurance companies write a professional liability insurance policy on a claims-made basis with a retroactive date and extended reporting period.

Retroactive Date

The retroactive date means you’re covered for incidents that happen on or after a specified date in your policy.

Extended Reporting Period

The extended reporting period helps cover claims filed within a certain time after your policy expires. This is generally a 30- to 60-day period, but you can extend this period to a year or more for an additional cost.

Your insurance company only covers claims against your business during your policy period within the extended reporting period. And the claim must be from a covered error or omission that happened after your policy’s retroactive date. It can help cover:

- Damages

- Legal defense costs

- Disciplinary proceedings

- Loss of earnings

- Subpoena assistance

Occurrence Policy

Some policies can also be written on an occurrence policy. This means there will be coverage for losses that happen during your policy period, even if the claim gets reported after your policy expires.

CLAIMS-MADE EXAMPLE

Since the claim was reported during the policy period and the loss occurred after the retroactive date, it would be eligible for coverage under a claims-made policy.

If a claim is brought after the policy’s expiration, it can get coverage if it’s reported within the extended reporting period.

Find Out More About Professional Liability Insurance

Other Business Coverages

We offer insurance coverages for companies of all sizes – large and small.

Last Updated: March 20, 2024

1 Premium amounts presented are based on monthly premium paid by The Hartford's Small Business customers between 1/1/22 and 9/14/23 for 12-month policies. Premium is derived from a number of factors specific to your business and may vary.

Additional disclosures below.